The average FTSE 100 annual report has now reached “epic” proportions, according to a campaign group.

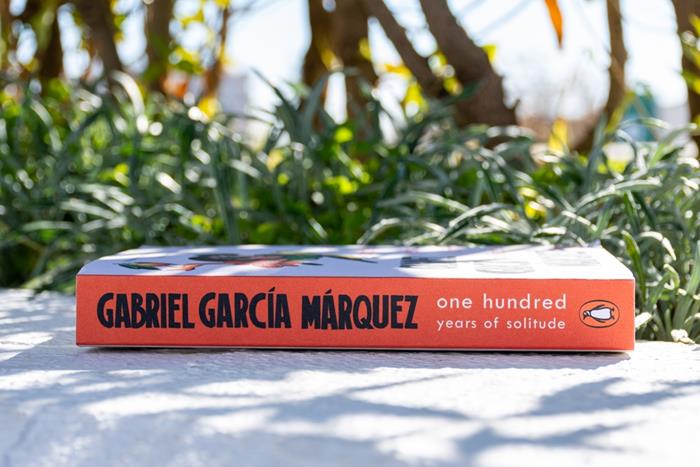

According to the Quoted Companies Alliance (QCA), FTSE 100 boards are churning out annual reports that have an average of 237 pages and a whopping 147,000 words. This, they add, is longer than either Charles Dickens’ A Tale of Two Cities or Gabriel García Márquez’s One Hundred Years of Solitude.

The growth rate of annual reports has the QCA troubled, too. On average, they expand by a stupor-inducing average of 8,400 words—or nine pages—per year.

QCA’s chief executive, James Ashton, is unimpressed and worried that ever increasing reporting requirements may be an impediment to companies floating on the UK stock exchanges. “Transparency is vital for public companies: it is what gives investors the confidence to invest.

But more disclosure does not mean better disclosure. The UK must be able to grow companies in the public arena without growing annual reports too.”

“These door-stopper documents,” he argues, are a case of “corporate complexity that must be reduced so the obvious upsides of listed life are not obscured for expanding, entrepreneurial businesses.”

Mid-sized companies have it better when publishing their reports each year: the average is 94,000 words and growing at 6,100 words a year.

However, AIM-listed companies appear to be seeing the biggest growth in reporting requirements, with their reports growing 51% inside five years —or 3,000 words a year.

Hard times

Ashton could be right to be worried about the attractiveness of listing. According to information service Statista, there were 1,954 companies trading on the London Stock Exchange as of December last year but in December 2015 that number stood at 2,365.

The response to falling numbers has, so far, been a change to listing rules, including an end to the ban on dual class shares, and allowing companies to list as little as 10% of their stock instead of a minimum of 25%.

Cutting reporting requirements might help but, at the moment, with pressure on companies to reduce greenhouse gas emissions, a move to shrink the disclosure burden is unlikely for the largest listed companies.

The outcome from a review of audit regulation over the past five years means watchdogs are currently consulting in a number of areas. These are: the form of a new report directors must publish on their internal controls; a new resilience report (to take over ‘going concern’ and ‘viability’ reporting); a report on how the risk of fraud has been managed; and new disclosures on audit and assurance.

Companies are already coming to terms with new sustainability reporting requirements. These are likely to change again once the government adopts new rules under development by the International Sustainability Standards Board.

Reports are big. And though some may claim they are unwieldy, likely to cause injury, or just too big to read in their entirety, such complaints are unlikely to make much impact.