Boards are under pressure to demonstrate their commitment to long-term value creation and show how they are delivering it in a balanced way, within a framework that measures their success. Politicians, consumers, suppliers and investors now place increased importance on long-term thinking as a means of tackling many of the big societal issues they see around them.

As such, long-term value is now on the boardroom agenda and firmly on the radar of enlightened investors, but boards need to get on the front foot and make sure they are able to articulate exactly what they mean by long-term value. Communicating this to their many stakeholders in today’s fast-moving business world is a challenge, which is why the messaging needs to be clearer than ever. This will require a new, dynamic reporting framework, one that is able to measure the value of a board’s long-term strategy, and one that helps investors and other stakeholders understand how this works for the benefit of all those involved.

–Hywel Ball, EY’s UK head of assurance

“The first thing to understand is that long-term value is not a new agenda item,” explains Hywel Ball, EY’s UK head of assurance. “All businesses are trying to create long-term value. But the need for businesses to better articulate their long-term strategies is becoming more acute.”

Ball believes this need is being driven by a number of factors. These include the growth of the knowledge economy and its impact on a company’s intangible assets as well as the explosion of big data and how companies, and their stakeholders, use it. There is also the disconnect between the short-term outlook of capital markets and the long-term vision of companies, together with the widening gap in trust between business and society.

As Ball says: “Businesses need to articulate how they are delivering value for all their stakeholders, not just the financial markets.”

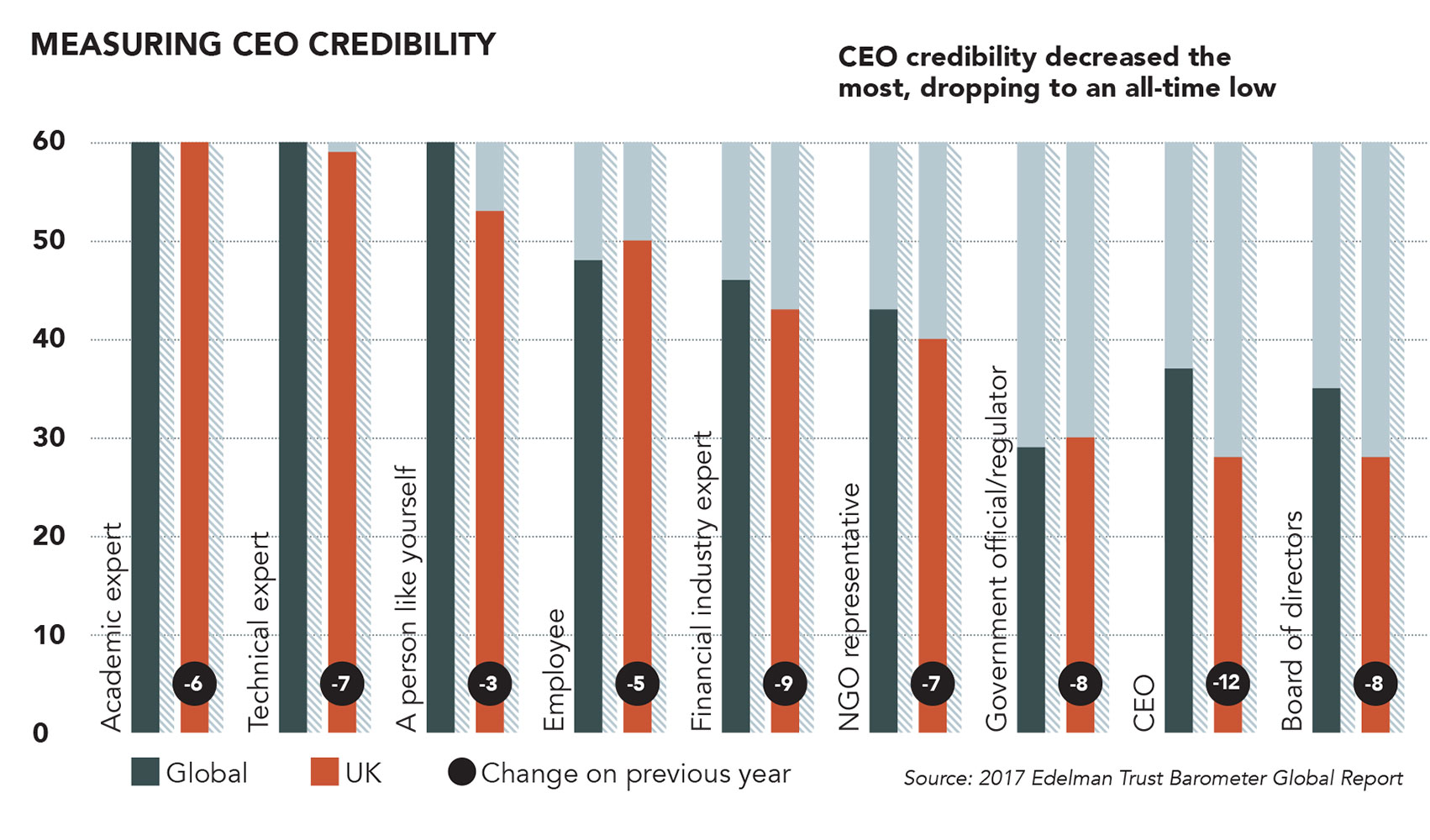

Research backs this up: according to the 2017 Edelman Trust Barometer (see graph, below), 63% of respondents believe that CEOs are not credible; while 78% of people think that businesses are unlikely to do the right thing in their community according to a 2016 study by the Institute of Public Policy Research.

At the same time, the 2016 FCLT Global study revealed that the pressure to demonstrate strong financial performance within two years rose from 79% to 87%.

Government and regulators are beginning to take this on board. According to the UK government’s 2017 Patient Capital Review, the failure of investors to take a long-term view is inhibiting investment. Meanwhile, the UK’s Financial Reporting Council (FRC) reported last year that stewardship (the role investors play in corporate governance) relies on “constructive engagement between companies and investors to build respect and trust, and help companies deliver long-term value”.

The FRC’s Stewardship Code is being reviewed during 2018, but businesses need to be taking this on board now as a result of growing stakeholder pressure, rather than waiting for government intervention.

“Business is being confronted with some of the same principles that governments have faced for many years around finite resources, different stakeholders and the balance between the short and long term,” says Barend van Bergen, EY partner and one of the firm’s team working with the Coalition for Inclusive Capitalism on a proof of concept to encourage, measure and demonstrate long-term value creation.

“Because there is evidence now that just focusing on the short term causes economic damage and erodes trust in business, the question of balancing the short with the long term is at the forefront of the corporate agenda,” van Bergen continues.

Role of the board

What is the role of the board here? According to Stephen Klemash, EY Americas leader for its Center for Board Matters, its role is to hold management accountable for long-term strategy—and it is a critical one.

“When it comes to making long-term investments, management faces an inherent conflict. They have to demonstrate short-term performance to survive in their roles, and they’re looking at a relatively short tenure.

“If I’m a CFO or CEO with an average tenure of five to seven years, where is the incentive for me to focus on investments that won’t move the needle for another eight to ten years? That’s where the board comes in,” explains Klemash.

“It is incumbent on boards to hold management accountable for making investments in innovation and transformation that will generate value over the long term—and they’re well positioned to do so,” he adds. “Board members are likely to outlast the company’s senior management team in their roles at the company, and they’re under increasing scrutiny from long-term indexed investors that want to understand how the board is overseeing long-term strategy.”

–Stephen Klemash, EY Americas leader, Center for Board Matters

Klemash draws a parallel with venture capital firms, which make a number of investments; only a handful of these need to succeed to provide a meaningful return. “The venture capital model is a valuable one, and boards should be looking to management to implement similar models of investment. This is about the board taking greater ownership and holding management accountable on whether it’s placing the right bets and giving those investments the appropriate focus.

“It’s also about communicating that strategy to investors and other key stakeholders to put short-term performance in a more accurate context.”

As Ball says: “The more you talk to people, the more you realise that some businesses have always been run without short-term shareholder consequence and have been able to articulate and know intrinsically what they are doing for their various communities and stakeholders.

“But currently the growth of intangible assets, as a result of the knowledge economy, and the explosion of big data, has accentuated the need for transparency.

“Other issues such as climate change and executive pay are also driving increasing focus on the role of business in society.”

According to Ball, businesses will be able to demonstrate the benefits of a focus on long-term value as stakeholders begin to have a better understanding of how the business creates value for them, but these businesses need to make sure they “reconnect with their societal contract”. Those that can do so successfully will be those that are able to explain and demonstrate their value proposition, gaining a competitive advantage and a market premium.

Van Bergen adds that there are also businesses that are being disrupted by technology that need to look to the long term and find responses to this disruption and increased competition. He also points to the systemic dichotomy between asset owners (individuals who contribute to pension funds, for example) who have long-term objectives but select assets, or delegate that job to asset managers, for short-term gains.

Critical questions

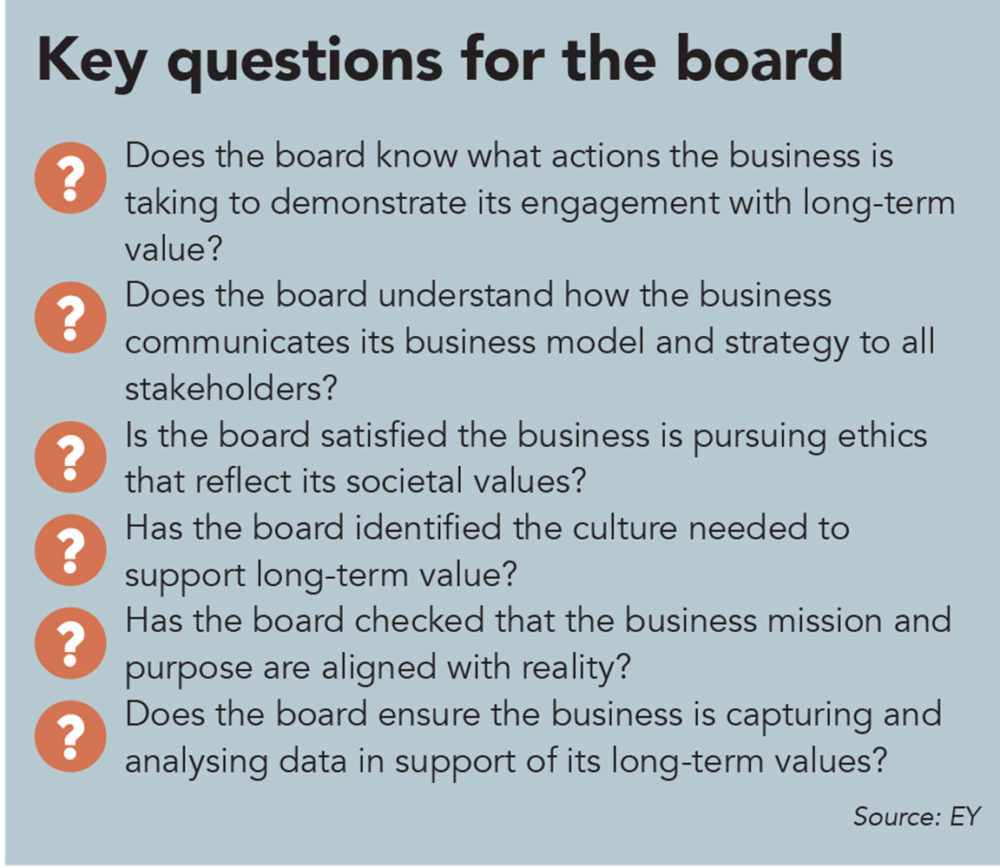

So, what are the critical questions that boards should be asking themselves and their senior leadership teams as they aim to achieve a balance between the demands of their various stakeholders—many of which are looking to the longer term, while others bring shorter-term pressures to bear?

The first is, what action are they taking to display their engagement with, and commitment to, long-term value creation?

As Ball observes, board directors are already the custodians of the long-term value creation strategy of the company, but they should be constantly challenging their own company and asking themselves whether they are happy now that strategy is being monitored and executed.

–Hywel Ball, EY’s UK head of assurance

“Are they satisfied they are disclosing to their stakeholders, in the best way, how the company is performing against this strategy?” Ball asks. This works at two levels: how the board is monitoring and measuring the executive team, and then what and how this is disclosed to external stakeholders.

Companies are required through law and regulation to disclose financial information to the markets in a timely fashion, but what else can or should be published? Regulations in a number of jurisdictions will cover mandatory disclosures across a number of environmental, social and governance metrics such as gender parity and data security breaches.

But there is still a need for wider “outcomes” to be measured, which is why EY has teamed up with the Coalition for Inclusive Capitalism, a not-for-profit organisation that promotes inclusive capitalism beyond corporate social responsibility, to create a framework for reporting on these wider outcomes (see “The Embankment Project”, below).

“Staff should be able to articulate what is important to them as employees of the company,” says Ball, “and executives should be able to measure how their activities impact this human capital. Outcome metrics can act as a proxy about how employees feel about their company, so does this match the value that the board is trying to drive for this group?”

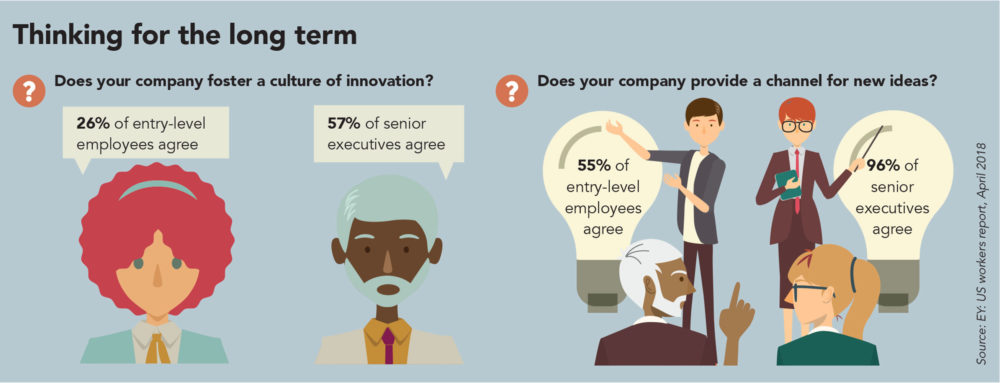

And as Klemash points out: “There can be a disconnect between senior management and the rank and file of an organisation.”

This is backed up by a recent study from EY which revealed that, while nearly all senior executives believed their company provided a channel through which to introduce new ideas, only 55% of entry-level employees believed that was the case (see below).

Good communication

As the above research demonstrates, good communication will play a critical role as the board seeks to articulate its strategy, both internally and externally. Any breakdown in communication will hinder the board’s pursuit of long-term value.

As EY sets out in its “Board Agenda 2018” series, board members must take a proactive approach to communicating with stakeholders—this is exemplified by the advent of the EU Shareholder Rights Directive. Corporate reports must deliver a clear and consistent view of the organisation’s value-creation strategy, one that is able to combine financial with non-financial measures.

Again, this is where work such as the Coalition for Inclusive Capitalism’s “Embankment Project” will become invaluable. As Lady Lynn Forester de Rothschild, chair of the Coalition, told Board Agenda: “We know what return on equity is, we know what return on capital is, return on assets, margins in operations. But how do we measure the value of a company that has a strict ethical basis?”

Lady Lynn was right to raise the issue of ethics, as the board’s attitude towards this subject can also have a considerable impact on the organisation’s long-term value. Indeed, as Ball says: “Ethics can have a significant impact on value creation and protection. For many businesses, it can be hugely important as it gives them the licence to operate.”

Ball adds that ethics can be multi-layered—there is compliance with laws and regulations, but also societal trust: “It is what people in the street think,” he says. As Lady Lynn told Board Agenda: “The populism, the lack of trust, the lack of optimism is all about society believing that the corporation, and the people who invest in those corporations, don’t have a purpose beyond their own self-interest. Society’s getting sick and tired of that, and I understand their frustration, even their anger.

“So, the best companies are those that understand their purpose, and their duty to their customers, their employees, and their communities in addition to their shareholders. Importantly, those companies have been proven, in various studies, to be the better long-term investment. They’re also just doing the right thing.”

Culture and values

An organisation’s culture sits hand in hand with values. “The tone at the top has a very strong impact, and it is increasingly possible to measure the health and culture of an organisation,” says van Bergen.

It is, however, a real challenge for boards, argues Klemash. “Boards have kept this at a high level and never looked at certain metrics lower down [in the organisation]. This has to change,” he says. Then boards need to ask themselves if their mission and purpose are aligned and whether this matches the reality of their business model.

This can be demonstrated in a number of ways. Karin Lutz leads EY’s “Women. Fast forward” programme focused on accelerating gender parity, and EY’s Beacon Institute, a community of business leaders, board members, and academics committed to helping organisations pursue a broad social purpose that goes beyond just short-term profits and shareholder returns. She points to one example: gender parity.

–Karin Lutz, EY

“Purpose and gender parity are two sides of the same innovative coin,” Lutz says. “If you’re a business leader looking to spark and sustain long-term value, you can’t find a better investment than that. Think about what drives value over the long term: an ability to grow and transform. A workforce of diverse views and experiences. A creative culture that empowers employees. An eye to the future and a vision for navigating it. That’s what purpose and parity bring to an organisation.”

“Interestingly,” Lutz adds, “EY Beacon research shows that more women than men believe purpose creates value for their organisation. The connection is clear: women are a driver of purpose. It is also true that purpose drives more women into an organisation. Inclusiveness is an essential driver of long-term value creation.”

Finally, boards need to understand the impact of data and analytics: even if they are not using the data that is now available to them, shareholders and other stakeholders almost certainly will be. “Increasingly, data will help make the case [for long-term investment],” says van Bergen. “Some investor groups, such as ‘quants’, do not interact with businesses at all, they just use data, and they are finding a correlation, and sometimes a causation for long-term value.

“As these correlations become stronger, and quant investors more successful, boards will start pushing for more data. In this context, data enables rather than disrupts.” Take these questions on board, and businesses will take a step closer to recognising their long-term value.

As Ball says: “Everyone we speak to confirms this is important, but its importance is accelerating.”

The Embankment Project

The Coalition for Inclusive Capitalism and EY last year announced that they were bringing together CEOs from more than 20 global companies, representing more than US$20trn of assets under management, to work on a proof of concept to encourage and measure long-term value creation. The project, called “The Embankment Project for Inclusive Capitalism”, is developing and testing a new framework to better reflect the full value companies create through human, physical, financial and intellectual capital deployment.

The 18-month project will involve six corporations from across the consumer products, health services and the industrials sectors, in addition to 15 investment and asset management organisations. The group will scrutinise, test and refine a framework that is being developed by EY. The results of this work are expected to be published later this year.

The EY long-term value framework

With a focus on outcome metrics to measure the achievement of stakeholder outcomes, the framework considers:

• The context, purpose, strategy and governance behind the outcomes that the organisation needs to deliver to its stakeholders.

• The stakeholders at the core of the organisation’s value creation model and the outcomes the organisation aiming to deliver to meet those stakeholders’ requirements.

• The types of value an organisation creates.

• The types of risk and threat an organisation has to manage to protect its value.

• The strategic assets, i.e. the capabilities and resources that need to be delivered.

This article has been prepared in collaboration with EY, a supporter of Board Agenda.

SPONSORED

SPONSORED