The real economic challenge facing the board and executive team of a listed company is not to maximise value for existing shareholders, or even to create shareholder wealth per se. Instead, it is to build an enduring institution capable of creating value for customers and wealth for shareholders on an ongoing basis.

The word “ongoing” here is key, because the way a company goes about creating customer value and building shareholder wealth is often the primary determinant of its ability to continue to do so. And it is entirely possible to pursue these joint and mutually reinforcing goals in ways that deliberately set out to enhance the wellbeing of all legitimate stakeholders, including the wider community and the environment.

Of course, there is no obligation for business leaders to steer their company in this direction—at least not yet. But those that do will need a clear understanding of the value or benefit that they are setting out to create for customers. Will it be real customer value stemming from the provision of useful, beneficial or healthy products or services, the consumption or use of which contributes to their customers’ long-term wellbeing? Or will it be artificial value arising largely from the satisfaction of desires created by successful marketing campaigns, with no thought given to their customers’ longer-term wellbeing?

If sufficient companies choose to focus predominantly on creating real or authentic value for customers, then the foundations of a new and more socially responsible business paradigm will have been laid.

Under that new paradigm, the goal of listed company leadership teams could be to seek to build enduring organisations that prosper through serving society. They could do this by creating real or authentic value for customers, by building significant wealth for shareholders, and by doing both in ways that quite deliberately set out to enhance the wellbeing of all legitimate stakeholders (including employees, suppliers, the wider community and the environment).

Noble intent

There are two components to the mindset required to move in this direction. The first is a noble intent or purpose that goes well beyond just seeking to maximise shareholder value. A focus on creating real or authentic value for customers reflects such an intent.

The second is the realisation that all legitimate stakeholders are really allies in creating customer value and building shareholder wealth over the long term—not adversaries in the pursuit of profit over the short term. In fact, the longer the planning horizon, the more the interests of all stakeholders align.

Central to this new stream of thought is a material breakthrough in applied corporate finance and business economics called the Bow Wave of Expected Economic Profits. The EP Bow Wave construct provides a complete financial justification for a more noble, more inclusive and perhaps more conscious approach to business. It has profound implications for corporate governance and offers unique insights into some of the most pressing issues that confront listed companies.

These include quantifying the impact on value of investing in innovation, and providing a clear and unequivocal means through which to resolve the tension that often exists between meeting short-term financial performance goals and creating value over the longer term.

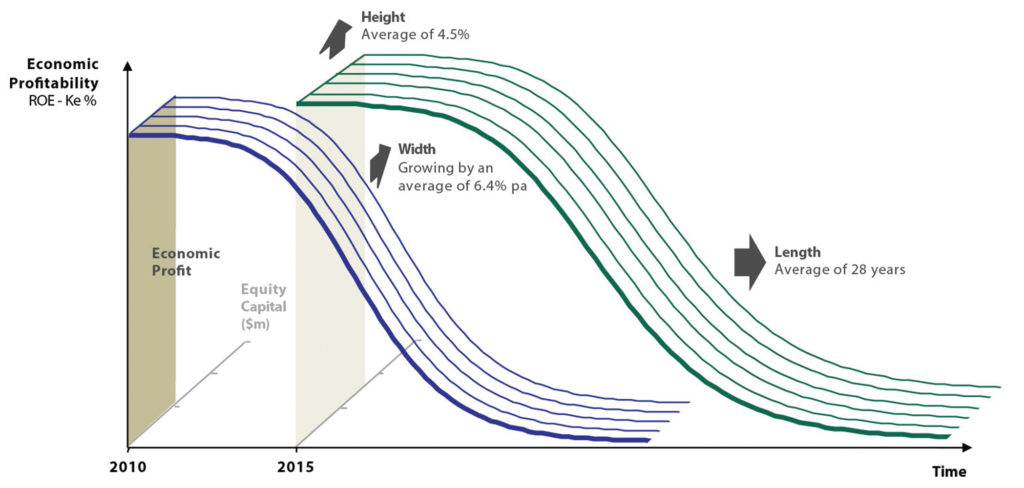

There is a Bow Wave of Expected EP embedded in the share price and market capitalisation of every listed company at every point in time. Wealth is created for shareholders, when management finds a way to enhance the shape of the EP Bow Wave—making it higher with enhanced returns, wider through greater growth, or longer from actions that make the business more sustainable, as illustrated in Figure 1, below.

The EP Bow Wave provides the first truly reliable mechanism with which to establish exactly how the performance achieved by management in the market for their company’s products and services translates into the capital market outcomes experienced by shareholders.

Indeed, it represents such a fundamental shift in understanding the economics of listed companies, that it provided Westpac Banking Corporation’s forward-thinking CEO Brian Hartzer with the analytical and conceptual underpinning of what he had come to believe through years of business experience: that despite what many executives and commentators believe, there is no conflict at all between doing the right thing by customers, staff and the community, and doing the right thing by shareholders.

Measuring wealth creation

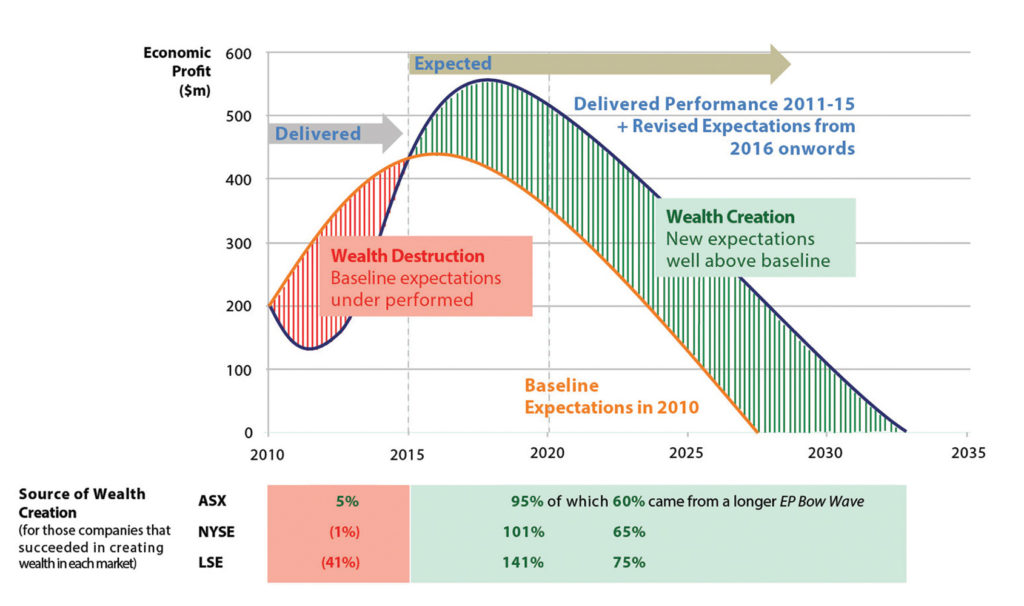

A Pair of EP Bow Waves constructed in two dimensions rather than three at the beginning and the end of a measurement period can tell us a lot about how wealth was created over that period. As is evident in Figure 2, there are always two potential sources of wealth creation: that created by exceeding existing EP expectations during the measurement period, and that created by establishing new EP expectations to be delivered beyond the measurement period. The latter is more important, and particularly so for more successful companies.

For the 63 ASX-listed, 69 NYSE-listed and 67 LSE-listed companies within the top 100 in each market, which succeeded in creating wealth for shareholders between 2010 and 2015, the main source of wealth creation was not exceeding existing EP expectations, but an increase in expectations in relation to longer-term performance.

The more successful the company, the higher the proportion of wealth creation that came from establishing new EP expectations (see the right-hand side of Figure 2, below), and the greater the proportion that came from making the business more sustainable (that is, from a longer EP Bow Wave). The underlying driver of this phenomenon is innovation focused mainly on finding ways to enhance value for customers.

This understanding runs completely counter to the views of most business commentators, many of whom are obsessed with companies meeting or exceeding short-term financial performance targets. Yet it supports the contention that the true economic objective of a listed company leadership team is to build an enduring institution.

A wealth-creating endeavour

Companies that become enduring institutions tend to have EP Bow Wave profiles that improve steadily over time, up to a natural limit of around 50 to 60 years. After that, maintaining the EP Bow Wave becomes a wealth-creating endeavour in its own right. But allowing the EP Bow Wave to erode will always destroy shareholder wealth, irrespective of current business performance.

The implications of this new understanding for corporate governance practice, for performance measurement and management, for executive reward plan design, and for the interpretation of the economic aspects of the fiduciary duties of directors, are significant.

In the case of fiduciary duties, in most jurisdictions directors’ duties are not owed to shareholders. They are owed to the company, with the interests of shareholders being satisfied through the success of the company. However, it is not uncommon for the economic aspects of those duties to be distilled into a requirement to maximise returns for existing shareholders.

The EP Bow Wave construct shows that this simplistic interpretation is built on an incomplete understanding. In combination with the EPS Myth (the widely held but misguided belief that enhancing short-term earnings or EPS will enhance shareholder wealth), this interpretation of directors’ duties has been contributing inadvertently to the propagation of short-termism within listed companies for many years.

One of the most important consequences of the understanding that comes with the EP Bow Wave construct is that the economic aspects of directors’ duties should probably be reinterpreted as a requirement to build an enduring institution that can create value for customers, and wealth for shareholders, on an ongoing basis. Success in this is evident in the shape, and in the change in shape, of the company’s EP Bow Wave.

There are many examples of this contained in our book, Customer Value, Shareholder Wealth, Community Wellbeing, published in August. The book also puts the case for a complete rethink of executive reward plan design.

The EP Bow Wave construct shines a light on the fact that current approaches to executive reward have also been a major contributor to the propagation of short-termism.

Denis B Kilroy is the co-author with Marvin Schneider of Customer Value, Shareholder Wealth, Community Wellbeing: A Roadmap for Companies and Investors, published by Palgrave Macmillan, August 2017.