Fuel-tied greetings

So, this year it’s ClientEarth’s turn to be the Ghost of Jacob Marley.

We jest, but ClientEarth, one of the UK’s most active campaign groups against climate change, has warned the UK’s 12 largest pension funds to use corporate bonds as a lever for companies to clean up their acts or potentially face legal action.

ClientEarth says around half of all financing for fossil fuel companies comes from bonds—fixed term loans. The campaigners argue that because pension funds have a duty to protect beneficiaries from financial risk, climate change in their bond portfolios should be top of their agendas. If not, lawyers may come a-carolling.

Catriona Glascott, a lawyer with ClientEarth, says pension funds investing in fossil fuel companies risk “breaching legal duties”.

“These funds have an enormous opportunity before them: by attaching climate terms to bonds they can help turn the tide of the energy transition and reduce their own legal risk.”

So not exactly full of the joys of Christmas, if you’re a pension fund corporate counsel. Having said that, if we want Tiny Tim skipping around in green, springtime meadows instead of arid plains, this might be worth a bit of thought.

Goodwill to y’all?

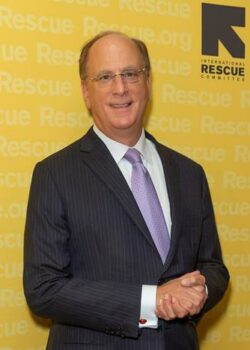

Over in the US, there is more Yuletide joy as the state of Tennessee sues the world’s largest fund manager, BlackRock, for ESG “misrepresentations”.

In short, Tennessee says BlackRock once thought ESG investing was full of value but seems to have backtracked. The state accuses the fund manager of “deceiving consumers”, according to Investment Week.

One bit of evidence they cite is BlackRock CEO’s Larry Fink’s decision to stop using the term “ESG”—which he declared in June this year—because it had become so politically toxic in the heightened state of US politics. We rather think the Tennessee law suit proves his point.

Moritz Christmas

Top of PwC’s Christmas gift list is a slew of new independent directors.

But the firm is having trouble around the world because it’s difficult to find suitable candidates who aren’t either affiliated with audit clients or prepared to work solely for PwC to meet independence rules.

Global chair Bob Moritz seems so concerned about it he was willing to bare his audit soul to the Financial Times.

“Given some of the structural complexities and the varying regulatory requirements on a country-by-country basis, our industry faces inherent challenges in bringing in a sufficient number of qualified independent candidates,” Moritz says.

Difficult to know how regulators will react to a call for softer rules. After a host of scandals around the world, “going easy” on auditors may not be the first thought among watchdogs. Still, PwC can always put it in their letter to Santa. Though he may ask whether the firm has been “naughty or nice”. You be the judge.

Tis better to give…

Here’s a bit of good news to end the year at Board Agenda: “altruistic” CEOs tend to lead companies that perform better on “corporate social responsibility” measures.

The conclusions come from a team of business boffins at Henley Business School and Edinburgh University. The team also finds that altruism is “not value destroying” and appears to help shield stock returns from “crises and recessions”.

“This study,” the team writes, “presents first-hand evidence of the positive impact that CEO altruism … had on the CSR performance of the firm the CEO leads.”

Looking for a New Year boost to your company? Get yourself a giving CEO.

Merry Christmas and Happy Holidays!