The UN Conference on Trade and Development (UNCTAD) and the International Integrated Reporting Council (IIRC) are working together to help companies report their performance, as the world looks to achieve the UN Sustainable Development Goals (SDGs).

The 17 SDGs were adopted by world leaders at an historic UN summit in 2015. They are designed to apply universally, to end all forms of poverty, fight inequalities and tackle climate change.

UNCTAD is responsible for addressing enterprise accounting and reporting issues in the UN system, and has been active in assisting countries to develop a strong corporate reporting system to facilitate investment through its intergovernmental working group of experts on international standards of accounting and reporting.

The IIRC is an international organisation promoting the concept of integrated reporting: a holistic form of reporting on the value created by a business, beyond purely financial value.

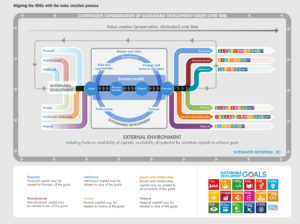

The methodology uses a ‘multi-capital’ lens—specifically intellectual, human, social and relationship, natural, manufactured and financial. These capitals are interconnected and bound together, integrating the value an organisation creates for itself and others, which is then communicated in its integrated report—telling a value creation story.

The International Integrated Reporting Framework sets the guiding principles and content elements, helping companies to improve the quality of their corporate reporting and embed a culture of integrated thinking.

Understanding value creation

Many businesses are now starting to integrate their performance and how they generate value against the global goals in their mainstream annual reports.

UNCTAD and the IIRC have joined forces to make this practice the norm by working with key stakeholders to help measure the number of organisations producing integrated reports, who are looking to achieve target 12.6 (one of the 169 targets that underpin the delivery of the SDGs). The two organisations signed an updated memorandum of understanding on 3 June at the UN’s European headquarters in Geneva, Switzerland, to deepen collaboration on promoting integrated reporting.

Goal 12’s aim is ensuring “sustainable consumption and production patterns”. And under this goal is Target 12.6, “Encourage companies to adopt sustainable business practices and sustainability reporting”.

How does the integrated reporting framework support companies looking to achieve this target and the SDGs?

Firstly, the framework is particularly helpful for sustainable development issues as it is based on the multi-capital model, including natural and human capital—two important kinds of value that are material to sustainability practices.

The holistic nature of the framework—which is underpinned by “integrated thinking”—allows for stakeholders to understand an organisation’s value creation story, and crucially for stakeholders to identify material sustainable development issues that influence value creation. This creates a greater understanding of all risk material to the organisation, and the impacts of the organisation in the long-term, both tangible and intangible. This in turn creates transparency for all stakeholders, highlighting which issues need more focus, shedding light on any risks or new opportunities—making the framework an effective tool to achieve Target 12.6 and all the goals.

This topic is discussed extensively by Professor Carol Adams, author of The Sustainable Development Goals, integrated thinking and the integrated report, who states that the framework is helpful for sustainable development issues as it demands a “long-term focus”, and has a “guiding principle of connectivity”.

Adams continues: “Further, [the framework] helps organisations understand (and articulate to their investors) the relationship between the value it creates for others and the value it creates for itself. It provides a framework for shifting the way individuals think about sustainable development issues and value creation.”

To understand the essential structure of integrated reporting, the diagram below articulates the connections between the six capitals and all 17 of the Sustainable Development Goals:

The framework is also helpful when having to answer risk disclosure calls by regulators, as, Adams says, “the importance of identifying and responding to sustainable development and other risks is increasingly recognised by regulators through calls to disclose significant risks and strategy”. This could also prove helpful in the future if the SDGs are incorporated into a legally required corporate risk disclosure regulation.

Indeed, when we re-signed our memorandum with UNCTAD earlier this month, Isabelle Durant, deputy secretary-general of UNCTAD, said that, “while challenges still remain with regard to how contributions to the SDGs can be more substantially integrated into corporate strategy and reporting, the international integrated reporting framework serves as an effective and flexible tool for tackling the key challenges for businesses in Goal 12”.

The updated memorandum of understanding signals that the IIRC and UNCTAD will continue to work together to help identify, and promote, the number of organisations that are developing integrated reports to meet Goal 12 and, specifically, target 12.6.

At the moment, UNCTAD’s current indicator for target 12.6 only looks at the number of sustainability reports produced. However, UNCTAD have now recognised the importance of integration and now include integrated reports in their figures for the indicator of the goal.

An integrated report is not a sustainability report: it is a communication about value creation that extends beyond ESG factors, and includes the strategy and business model of the organisation, bringing both greater insight about management decisions and foresight about future plans within mainstream corporate reporting. High-quality integrated reports will incorporate data and information about sustainability matters, where it is material to the organisation’s ability to create value over time.

Linking goals to strategy

Multi-capitalism and integrated reporting not only work on a structural level for companies to successfully achieve target 12.6, and also the wider aims of Goal 12: “sustainable consumption and production patterns”, but also chimes with the wider philosophy of all seventeen of the goals: that everything we do as individuals and companies is interconnected and creates an effect on our communities and the planet’s ecosystem.

The overarching purpose of the SDGs is to mobilise governments, capital markets and communities to change their behaviour systemically to regenerate and restore the damage that has been done to the planet and to our own communities; to understand and illuminate the effect of how we create value over different time horizons; and to create balance and harmony between all the different and finite planetary resources. Such a universal mission cannot be completed by policymakers alone—it will take a genuine partnership between all stakeholders.

Integrated reporting is a highly effective tool for organisations to deliver on this promise, by marshalling all the relevant resources, being accountable for their use and telling their value creation story.

An example of a company using integrated reporting to successfully achieve the 2030 SDGs is AkzoNobel (the Dutch multinational which creates paints and performance coatings for both industry and consumers worldwide) whose 2018 annual report states that the company looks to align their business opportunities with the most relevant SDGs. The report illustrates this by providing a visual with coloured dots categorising the relevance of the SDGs to ‘Operations’, ‘Markets’ and ‘Identities’ as main, intermediate or minor, within the context of stakeholder engagement.

It can be tempting for companies to look at the SDGs as an opportunity to “greenwash” their companies—a marketing ploy to be perceived in a noble light. But if you are addressing them without integrating them into your business model—a superficial approach that will not lead to real and long-lasting change—then one may as well not try at all, and arguably the goal(s) in question cannot be truly met.

In contrast to this is the example set by Turkish bank TSKB. Turkey’s first privately owned investment and development bank has looked to integrate the SDGs into its business strategy. Its 2016 integrated report demonstrated that sustainable development is central to its strategy and critical to the value creation process by making it central to the materiality analysis.

Integrated dimensions

The UN has also stated that in order to achieve sustainable development by 2030, account has to be taken of the indivisible and integrated dimensions of the economy, society and the environment.

An example in the case of a large corporation working with governments is British Telecommunications Plc. The company has been inspired by the SDGs and taken a novel approach in considering where the ICT industry as whole can contribute to the achievement of the SDGs, and have explored “the potential impacts on our business, if the Global Goals are not achieved by 2030 in the markets where we operate”.

This example is interesting in that the company has looked to spread responsibility across their wider industry, and the countries in which it operates and builds telecommunications infrastructure. They see countries and their governments as their partners (which has always been the case with this industry), and so challenge them to meet them on the Global Goals as they know the industry cannot meet them without their cooperation.

The SDGs can only be truly met should they be properly integrated into an organisation’s business model, as the above examples have done, to deeply and thoroughly take ownership of relevant goals. This will still allow for the organisation’s strategy and business model to evolve and to reflect past performance with respect to the SDGs—only then does an organisation take proper ownership and responsibility.

Professor Mervyn King, Chair Emeritus of the IIRC, said when asked of the importance of the SDGs: “There is not only a corporate necessity to do this. There is moral duty to ensure that development is sustainable. We have to achieve sustainable development that meets the needs of the present, without compromising the ability of future generations, your children, your grandchildren, to meet their needs. This is a primary ethical and economic imperative.

“While we have crimes against humanity, we also cannot afford lawful wrongs against humanity. There has to be a change from shareholder-centric governance models to company-centric models—the long-term health of the company.”

Jonathan Labrey is chief strategy officer at the IIRC.