Let’s discuss ESG

UK board members seem less optimistic about investment in ESG than counterparts on the continent. Research from BoardClic shows 68% of UK board members say ESG investment adds value, compared with 88% in Nordic countries—and an average of 83% across Europe.

Monica Lagercrantz, BoardClic’s founder, says: “If a board doesn’t regularly discuss ESG strategically, it’s unlikely that management and employees will incorporate those factors in their daily activities. Integrating ESG into strategy can help drive company innovation, reduce risk, create new markets and spur engagements in employees and top management.”

The long view

If a chief executive holds stock in their company long term, the company tends to benefit. That’s the view of business prof Alex Edmans. Speaking at an FT event, Edmans said: “If the stock were stock that you could sell in one year’s time, then you would push up the short term stock price,” he said.

“But increasingly, these stock holding periods have been rising, because the new Corporate Governance Code recommends this extends from three years to five years as a minimum. There are many executives who are required to continue to hold stock in their companies even after their departure, which is important so their horizon extends beyond their tenure.” Sage advice.

Sun’s out, codes out

Why would big companies not offer a code of ethics to their employees as guidance? Chris Cowton, associate director at the Institute of Business Ethics, offers some answers.

Some simply don’t have a code to post. But there are a number who have codes and don’t publish them. That may be for good reasons but it could also be because the code is a bit rubbish and “it would be embarrassing to disclose the code”.

Or it could be because some companies are frightened to be held to account.

“A publicly available code is a statement of commitment,” writes Cowton, “an indicator of what stakeholders can expect from a company.” So some companies might duck putting their codes out there for the world—investors and other stakeholders—to see. About time the no-coders came out of the closet.

Rising son voted down

Japan and executives there are coming to terms with a fast-changing governance culture. This week’s shock to the system is proxy advisor Glass Lewis advising against voting for the re-election of Toyota chair Akio Toyoda, grandson of the company’s founder.

Glass Lewis argues that Toyota’s board does not have enough independent directors. Meanwhile, ISS is proposing to back another shareholder demanding more disclosures about the auto-maker’s lobbying on climate issues.

Governance is certainly becoming big in Japan.

TV winners

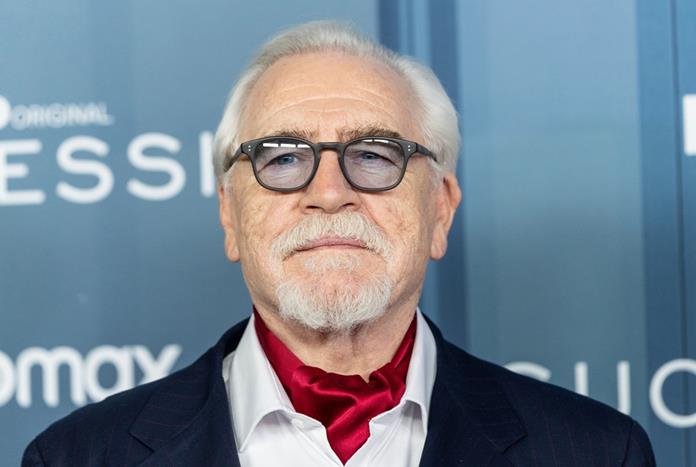

Who could have guessed? Forbes magazine has published an article detailing the management lessons to be drawn from HBO’s much talked-about series Succession (if you haven’t seen it, Brian Cox (pictured) plays someone like Rupert Murdoch, while other characters are ciphers for the rest of the clan).

Chief among this counselling is: “Don’t let emotion or knee-jerk reactions govern or influence how a crisis is managed.” It adds that decision-making should be done with “careful, deliberate and strategic considerations”. Also, “do not repeat or spread rumours”. Poor advice for writers; essential virtues for board members.