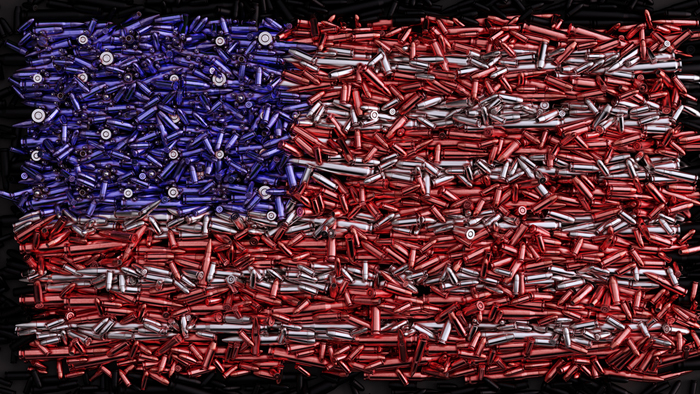

ESG and gun control

Following the appalling mass murder at Robb Elementary School, Texas, a firearms business this week faces a challenge from investors—a signal that gun control could become an ESG issue.

A small group of investors in the gun company Sturm Ruger has lodged a shareholder proposal demanding the company order an independent “human rights impact assessment” of the company’s products.

The proposal comes from CommonSpirit Health and fellow members of the Interfaith Center on Corporate Responsibility, based in Manhattan, and will be voted on at the firm’s AGM on 1 June.

Wall Street observer Emily Flitter writes in the New York Times: “Even if it passes next week, the resolution will not force the company to act. But the view of activist investors is that any kind of influence over the gun industry is better than none at all.” You do what you can.

CEO pay bonanza

Deloitte confirmed this week what we already know: chief executive pay has recovered from its pandemic blip and has returned to levels last seen just before Covid-19 turned the world upside down.

Median CEO pay in the FTSE 100 is now £3.6m, close to 2018 levels and closing in on the 2017 high of £4m.

Last week think tank the High Pay Centre revealed that the average pay ratio (CEO to average worker) for 69 companies in the FTSE 350 that have so far reported has risen to 63:1, nearly double the 34:1 found in 2021 for the same group of firms. Maybe boards are just helping CEOs with the cost of living crisis? No? Oh, right.

Peltz joins Unilever board

Nelson Peltz, one of the world’s most high-profile activist investors, is to join the board of Unilever after acquiring around 1.5% of the company’s shares.

This could be a significant moment for the company, especially chief executive Alan Jope who has moved to defend the firm’s focus on sustainability after scathing criticism from other investors. Speaking at Davos last week, Jope said: “It’s been a torrid time for the world over the last two or three years, but one constant is that Unilever’s investors have exhorted us to continue on the path of putting sustainability at the heart of our business model.”

Peltz is on record saying he is a “big believer in ESG” and a policy statement from his firm, Trian, says: “Trian believes that environmental, social and/or governance (ESG) issues can have an impact on a company’s culture and long-term performance…”.

However, footnote #1 on the policy says: “While Trian views the consideration of ESG factors as an important part of its due diligence process, the results of our ESG analysis of a potential portfolio company have not altered our long-standing investment strategy.” So, that’s reassuring.

Leaky listings

If policymakers and executives at the London Stock Exchange want to save it from long-term decline they have to stem the leakage of companies from the market, not overly focus on new listings, and that may mean easing the “governance burden” on companies, according to two Cambridge academics.

Writing for the Oxford University governance blog, Brian Cheffins and Bobby Reddy, both law professors at Cambridge, argue a sole focus on improving IPOs, through relaxation of listing rules, may be “misguided”. Exits from the market are the real threat.

“To truly resuscitate the London Stock Exchange, policymakers need to be sensitive to the drivers of the relentless leak of companies from the market,” they write.

“The onerous requirements of the Main Market can become draining for boards and stymie company innovation, making de-listing companies easy prey for, often overseas, corporate raiders.”