The more gender and age-diverse a boardroom is, the more likely it is that companies take firmer, more decisive, and measurable action to mitigate risk and adapt to climate change.

This is one of the key insights from research conducted by sustainability consultancy A Bird’s Eye View in partnership with non-profit BoardReady, which analysed 159 global companies identified by the Climate Action 100+ initiative as responsible for over 80% of corporate greenhouse gas (GHG) emissions against the initiative’s net-zero benchmark indicators, and their board’s composition.

The findings suggest some of the most important companies in the world are not ready to respond to climate change. One reason, the research highlights, could be that their boards do not have the composition or practices to provide the oversight needed to put climate at the centre of strategic planning.

The research revealed four critical levers boards can use to improve company engagement across all critical climate action indicators: greater board gender and age diversity, more formalised climate governance, prioritisation of reporting and disclosure, and climate performance incentives.

The performance-based evidence is relevant not only for global companies but also medium and smaller businesses as boards and management consider how to transform while continuing to perform, and in some cases remain liquid.

Commitments and actions

Previously seen by some as a reputational risk, the significance of climate change is being elevated and directly linked to financial performance and reporting.

Initiatives include the EU Taxonomy’s proposed carbon border tax; the world’s first net-zero corporate standard from the Science Based Targets Initiative (SBTi); mandatory disclosure requirements using the Task Force on Climate-Related Financial Disclosures (TCFD) framework; and the newly formed Glasgow Financial Alliance for Net Zero (GFANZ), aiming to raise capital and integrate climate change in every financial decision.

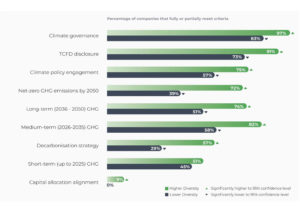

Yet with record levels of “green finance” being mobilised, there is a significant disconnect between company net-zero commitments and actions. 80% of the global companies researched have or will implement TCFD recommendations, over 50% have made some level of commitment to net-zero GHG emissions by 2050, yet only 4% have disclosed future capital allocation plans aligned with their reduction targets.

The results show a positive correlation between greater gender diversity and age diversity on boards and substantive company climate action across nine net-zero benchmark indicators. These include acting on climate risk and policy, setting medium and long-term GHG reduction commitments, and the development of a decarbonisation strategy and plan including capital allocation alignment. As companies look to accelerate their transition to net-zero, the findings suggest more diverse perspectives can lead to better quality debate and more comprehensive decision-making in the boardroom.

Company boards are becoming more diverse, increasingly influenced by gender representation polices and laws introduced by some countries, but many still have a way to go. Only 41% of the global companies assessed have at least 30% of board seats held by female directors, and just 36% have boards with a median age under 60 years.

These observations raise the question, what do female directors bring that makes the difference on climate and why should more gender diversity be prioritised?

Diversity and perspectives on climate

According to the US Annual Corporate Director 2021 survey recently released by PwC, female directors bring a different perspective to the debate about climate and ESG and its financial impact on company performance. Female directors are more likely than male counterparts to think ESG should be linked to company strategy, be part of board ERM discussions, and support its inclusion in executive compensation plans.

Another key factor could be the belief and the drive of the chair to foster an inclusive culture to encourage diverse views and debate, and importantly set the board agenda, oversight, and accountability on climate. The study supports taking this approach. It found companies with both climate-related board oversight and executive remuneration are performing better across all climate action indicators particularly in decarbonisation strategy development, and future capital allocation aligned to GHG reduction targets.

Half of the companies assessed have some form of climate-related board oversight. However, only 31% have climate-linked executive remuneration schemes in place, despite these incentives being more effective at driving companies’ short-term GHG targets. Just 21% of companies have the combination of climate-related oversight and remuneration.

As boards consider their fiduciary duties amid increasing stakeholder scrutiny, there are four critical levers they can use to increase company engagement on climate change. The evidence shows a clear link between board diversity and company performance on climate. The world is watching as they look at global companies for clarity and conviction, bold decisions, and strong inclusive leadership.

Company engagement on climate is increasing. The transition to net-zero still has a long way to go. More diverse boards and better stewardship on climate will make a positive contribution. The key lever starts with a more diverse boards willing to challenge themselves and put climate at the centre.

Helena Wayth is the founder and managing director of strategic business and sustainability consultancy A Bird’s Eye View.