Shareholder revolts over pay are on the rise. Figures from the Public Register of shareholder voting show that investors have increased the rate at which they object to remuneration reports. According to some, that may be driven by disappointment that boardroom pay in some quarters remained high last year despite the pandemic crippling many business sectors.

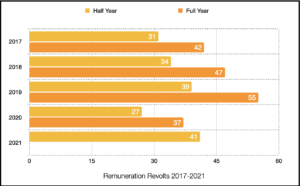

According to Board Agenda analysis, pay revolts in the first half of 2021 are up on the same period last year by 51%. So far, 41 AGMs have seen votes of 20% or more of shareholders against remuneration. That’s up on the 27 in the first half of 2020 and ahead of the 37 for the full 12 months.

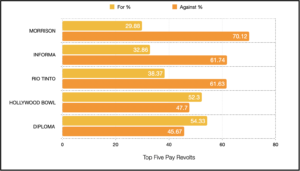

Indeed, June this year saw one of the largest pay revolts of the last five years with 70.12% of Morrison Supermarket’s shareholders voting against the board’s pay report.

The increase comes against a background of slightly lower, or flat, CEO pay levels. In August last year The High Pay Centre’s annual assessment of the FTSE 100 found median chief executive pay had fallen 0.5% between 2018 and 2019, or to £3.61m from £3.63m. Research from Deloitte concludes that median pay fell to £2.85m in 2020.

‘Focused on pay fairness’

Deloitte research out tis week also shows the number of pay revolts rising. According to Stephen Cahill, vice chair of Deloitte, shareholders may be reacting to concerns that boardroom pay at some corporates did not suffer in the same way as their employees during the pandemic.

“While the vast majority have shown restraint, investors remain focused on pay fairness and will vote against remuneration reports where executives are seen to be insulated from the wider stakeholder impact,” he told the Financial Times.

However, companies also operate in an environment that has witnessed increasing interest in corporate attitudes to environmental, social and governance (ESG) issues, another factor that may lever pressure on CEO pay packets.

Luke Hildyard, director of the High Pay Centre think tank, says it could reflect an interest in issues caputed by the “S”, or social concerns, in ESG. However, he adds: “It’s important not to overstate the trends. The overwhelming majority of pay awards are still approved without radical reductions in pay occurring.”

Last year companies received numerous warnings from big investors that executive pay should respond to the pandemic. Both Schroders and Hermes made it clear they were watching how pay levels reacted as workers were furloughed or made redundant as a result of Covid-19. Hans-Christoph Hirt, executive director of Hermes EOS, warned boards in a letter: “Management remuneration should be appropriately aligned with the experience of the wider workforce and society and adjusted taking a company’s circumstances into consideration.”

Meanwhile, early research published in August by the High Pay Centre found few companies responded. The report said only 36 companies in the FTSE 100 had, by then, announced cuts to executive pay. And those were “mainly superficial or short term”.

Diverse views on pay

Analysis of Public Register figures shows that over the past five years of record keeping pay revolts peaked in 2019, a year before the pandemic, with a total of 55 and 39 at the six-month point. That came after years of growing concern about rising levels of pay. Current trends, however, could that number eclipsed in 2021.

Shareholder concerns fell off in 2020 with an annual total of 37 revolts as investors eased the pressure.

However, there is increasing interest in the factors driving attitudes and approaches to setting boardroom pay. This week new research suggests investors and non-executives have diverse views on what they are trying to achieve. A survey conducted by academics at London Business School and the London School of Economic reveals that 65% of directors say they work to attract the right leader while 34% say it’s all about creating a deal that motivates a CEO. It’s the reverse for investors: 44% say it’s about finding a star, 51% say it’s about motivation.

However, 77% of non-executives say shareholder “guidelines” have obliged them to cut pay. When they were asked about the outcome 42% say it produced “no adverse” effect, though 42% declared that their CEOs were less motivated.