Company chairmen are to be granted flexibility in the UK’s new corporate governance code to be considered independent beyond nine-year terms, according to a senior figure behind the new document.

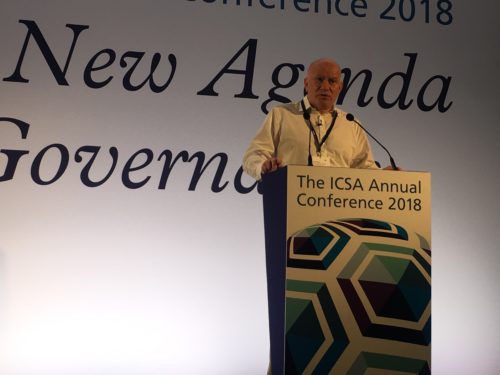

David Styles, director of corporate governance at the Financial Reporting Council, told a conference this week that the move had been made to encourage gender diversity in board leadership.

Styles said the new code would offer the opportunity for chairs to be considered independent after more than nine years if they were an “internal promotion” and had served part of their time on the board in another role.

The new code is expected to be published on Monday. Earlier this year the FRC released a draft governance code for consultation, with elements on non-executive directors that controversially suggested a chairman could not be considered independent beyond a nine-year term.

–David Styles, FRC

Styles told the annual conference of ICSA: The Governance Institute that the FRC had encountered concern during consultation that the “nine-year” guideline would limit the terms of chairs who may have joined as a non-executive before taking on leadership of the board.

In December, the Financial Times ran a story saying the nine-year limit would affect the chairmen of 67 companies, including 19 in the FTSE 100 index.

Styles said the FRC “came across data that suggests it is more likely that a woman will be made chair from an internal appointment rather than a direct hire from outside.

“In terms of promotion of diversity, that’s why we have set out particular circumstances where … we consider it OK for there to be flexibility to breach a time limit for a chair’s term.”

Styles would not offer detail on what the new nine-year code clauses would say, but he reiterated the FRC’s belief that chairmen should have their time in charge constrained.

“We do think it’s important that the chair be considered independent upon appointment.”

He added: “But we also think that effective refreshment of the chair should take place. And effective refreshment of the chair, particularly if the chair chairs the nominations committee, will lead to effective refreshment of the board.”

Remco reform

Styles also flagged changes to the role of remuneration committees. He said many observers feared the consultation draft of the new code gave committees “executive” responsibility over the pay of employees as well as directors and senior managers.

“What we’ve done is make it clear that we are not expecting the remuneration committee to have executive authority over these things, but they have to have a full understanding of what they are.”

Changes to the role of the remuneration committee stem from an attempt to give boards a view of how workers are affected by executive pay deals.

Styles said the FRC also came across concern about provision in the code for worker engagement. The draft said companies would “normally” use one of three methods: a worker on the board, a workers’ panel reporting to the board, or a NED representing worker views.

Styles said the final draft of the code had been amended to recognise other forms of worker engagement, including trade unions.