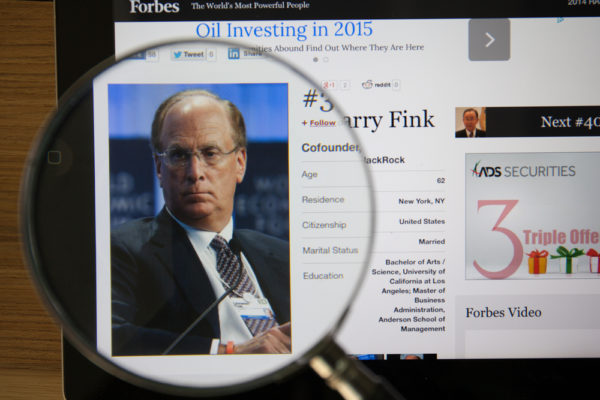

Larry Fink, chief executive of BlackRock, the world’s biggest asset manager, has said companies must make a “positive contribution to society” and benefit all of their stakeholders.

The views come in Fink’s annual New Year letter to company leaders around the world and in the year BlackRock approaches its 30th anniversary year.

He said BlackRock would step up engagement, doubling the size of the asset manager’s investment stewardship team over the next three years, and opening up engagement with index funds.

Fink said: “Society is demanding that companies, both public and private, serve a social purpose. To prosper over time, every company must not only deliver financial performance, but also how it makes a positive contribution to society.”

Fink warned that engagement would no longer be about annual general meetings and proxy voting.

“The time has come for a new model of shareholder engagement—one that strengthens and deepens communication between shareholders and the companies that they own.” He added that “shareholder engagement has been too focused on annual meetings and proxy votes.

“If engagement is to be meaningful and productive—if we collectively are going to focus on benefiting shareholders instead of wasting time and money in proxy fights—then engagement needs to be a year-round conversation about improving long-term value.”

Fink said the expansion of BlackRock’s stewardship team would “foster even more effective engagement with your company by building a framework for deeper, more frequent and more productive conversations.”

Emphasising that companies should have a purpose, Fink emphasised the importance of companies publishing a statement of long-term strategy.

“Your company’s strategy must articulate a path to achieve financial performance. To sustain that performance, however, you must also understand the societal impact of your business as well as the ways that broad, structural trends—from slow wage growth to rising automation to climate change—affect your potential for growth.”