As anyone who has served on a board knows, what happens in practice in company boardrooms can be far different from best practice corporate governance standards, such as those promulgated in the Financial Reporting Council’s (FRC) UK Corporate Governance Code. Why is the practice of corporate governance so different from best practice standards?

The practice of corporate governance

We use the umbrella term, “the practice of corporate governance”, to refer to: (i) corporate governance best practices (i.e., social norms and rules, best practice); (ii) practitioners (e.g., chairmen, executive directors, non-executive directors, internal auditors, external auditors); and (iii) praxis (i.e., activities).

Once the human element (practitioners) is introduced, best practice becomes praxis. Regulators are aware of the disconnect between best practice and corporate governance in practice (i.e., praxis).

For example, in its 2016 report, Corporate Culture and the Role of Boards, the FRC states: “The combination of legislation, regulation and codes provides a flexible framework for companies and their stakeholders to pursue their objectives and achieve long-term success. Success depends, however, on the spirit with which companies and investors apply the principles and use the flexibility they have.” (FRC, 2016, p4).

Regulators now emphasise the importance of disclosing praxis and not simply reporting compliance with practice (i.e., rules, best practice).

For example, the FRC’s Lab Project Report (2013) on reporting by audit committees emphasises the importance of audit committees “say[ing] what you did” (i.e., praxis) “not just what you do” (i.e., best practice).

The examples of audit committee reports cited in the FRC Lab Project Report highlight the importance of: (i) language (e.g., using “examined” instead of “reviewed”); (ii) instilling “soft” confidence/assurance (e.g., we reviewed and we are comfortable); (iii) adding “colour” to the description of audit committee work and avoiding boilerplate explanations; and (iv) personalising audit committee reports, perhaps creating a sense of familiarity and trust.

Thus, regulators seek better evidence that audit committees fulfil their oversight role including examples of the praxis (i.e., activities) they undertake in fulfilling their role.

Practices, practitioners and praxis

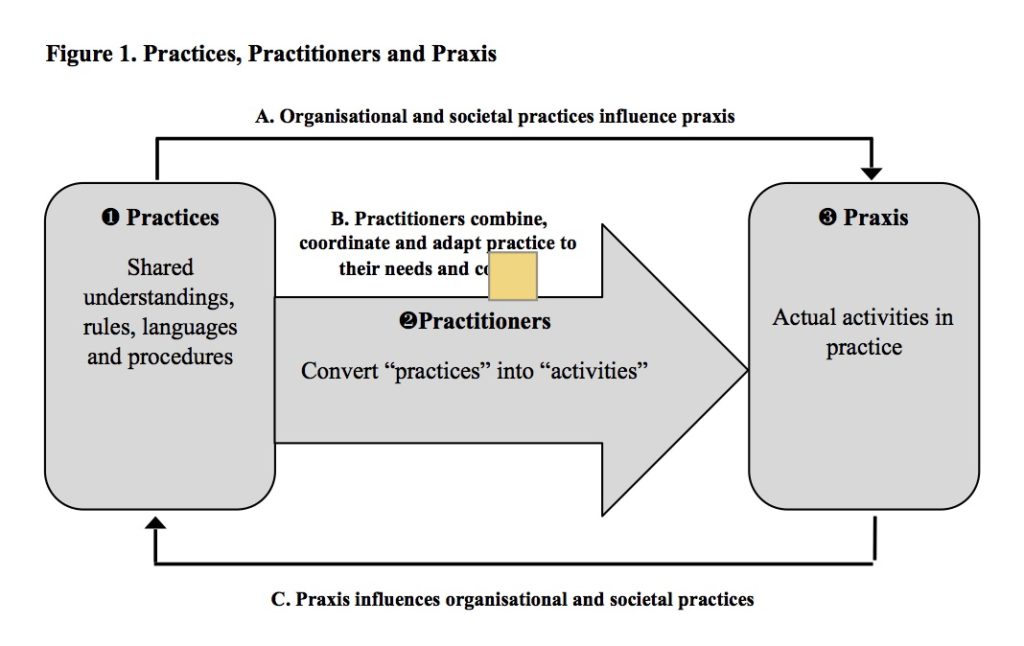

We illustrate best practice/practioners/praxis in Figure 1 (below) which shows how these three elements of the practice of corporate governance (our umbrella term) are connected.

The distinction between practices and what happens “in practice” depends on practitioners and their skills and initiative to convert practices into activities or “praxis”.

This distinction is captured by the FRC’s statement that “while legislation, regulation and codes influence individual and corporate behaviour, they do not ultimately control it”.

Practices inform praxis (A in Figure 1). Practitioners draw upon practices when they perform an activity. The conversion process from practices to praxis does not involve mindless reproduction of ascribed practices. Praxis represents activities that do not stand by themselves. Human actions create activities, and practitioners can change and improve those activities (or not).

Practitioners combine, coordinate and adapt practices to their needs and context (B in Figure 1). Without practitioners, practices (i.e., norms, rules, best practice) cannot be converted into praxis (i.e., activities).

Practitioners perceive, interpret and adapt practices to convert them into activities. They can shape activities through who they are, how they act and what practices they draw upon in their action.

Through this adaptation process, and in a recursive relationship, praxis can shape practices (C in Figure 1), i.e., in a feedback loop, corporate governance activities in practice (i.e., praxis) influence societal shared understandings of rules and norms of corporate governance that are shaped by practitioners’ interpretation and adaption of practices (B in Figure 1).

Thus, part of the resources of practice include corporate governance legislation, rules and norms, which practitioners both draw upon and change.

Illustrating the practice of corporate governance in audit committees

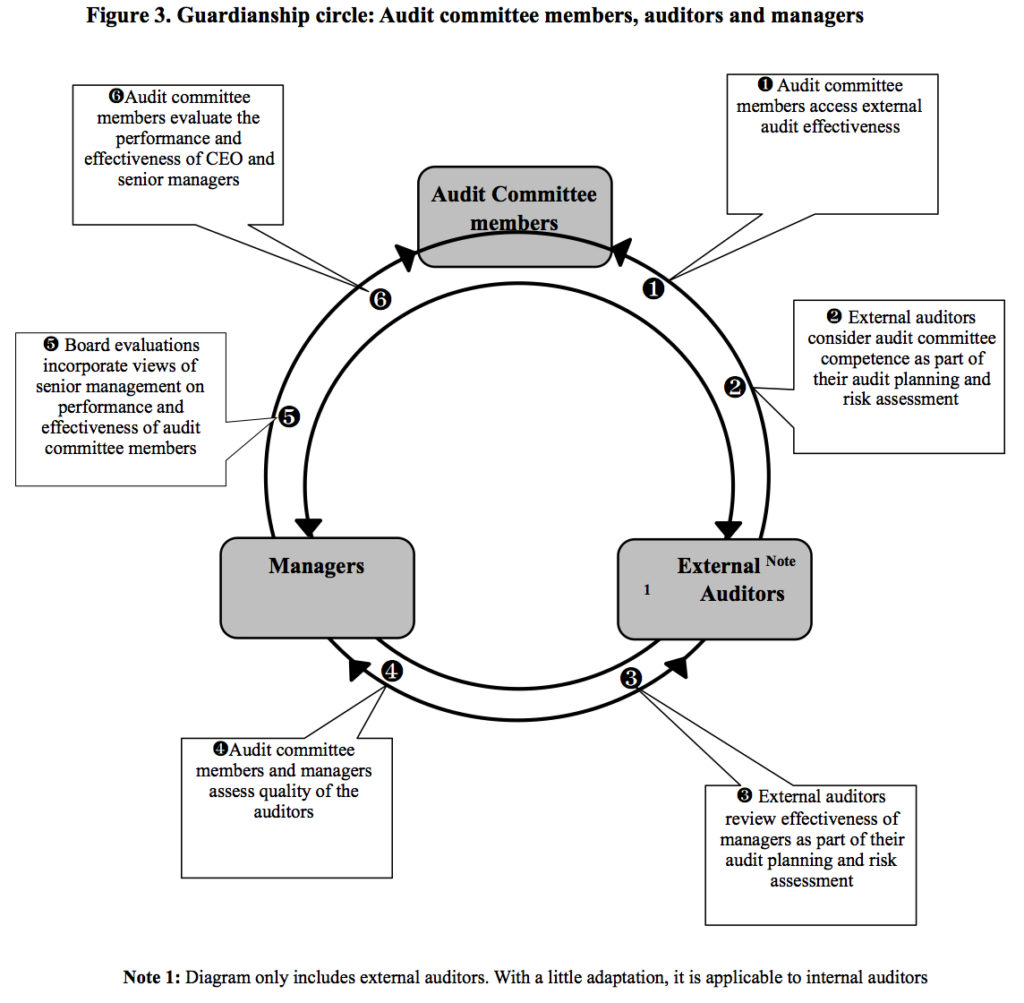

Figure 1 may appear quite abstract to readers. By applying Figure 1 to the work of audit committees in Figure 2 (below), we illustrate how our abstract model applies in a specific governance context—the work of audit committees.

Guardianship circle

Guardianship circle

The practice of corporate governance relies on practitioners interpreting and converting corporate governance practice into praxis.

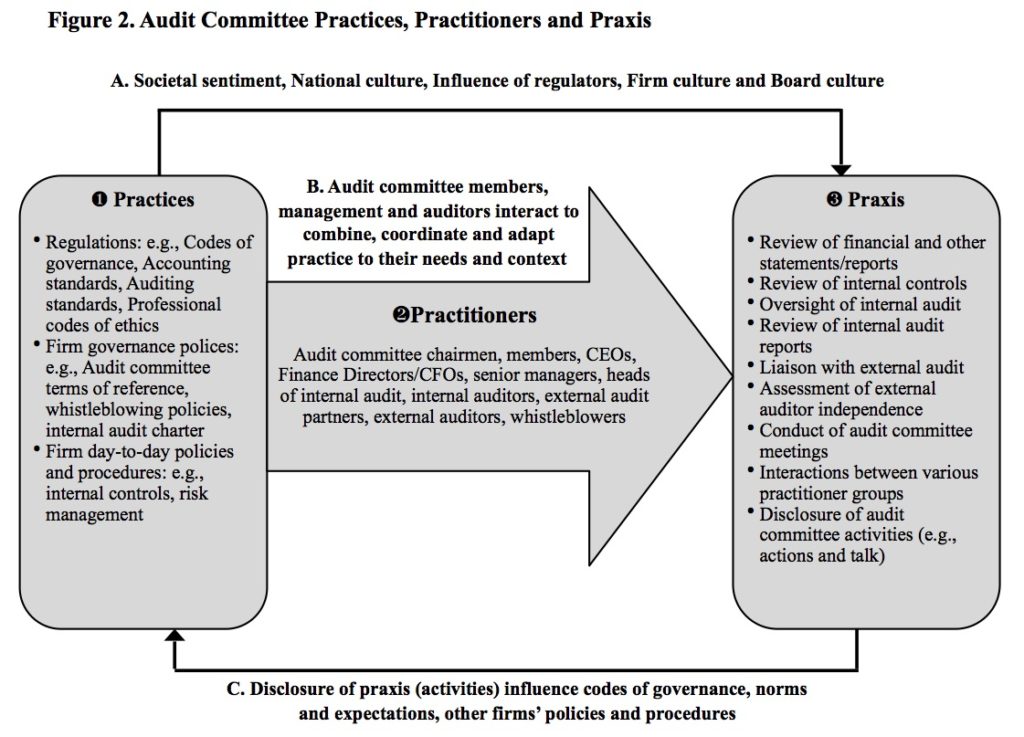

However, audit committee members cannot operate the practice of corporate governance in isolation. In Figure 3, we show how the practice of corporate governance comes together in a guardianship circle, reflecting the higher-level duty of boards of directors to look after the best interests of the firm. Figure 3 illustrates the reciprocal evaluation processes between audit committees, external and internal auditors and managers, highlighted by the FRC (2013).

The guardianship circle implies that everyone is a guardian of everyone else. If audit committees exist in a guardianship circle, it is necessary to consider their role by reference to the role of others in the guardianship circle.

Thus, (i) audit committee members oversee the conduct of internal and external audits, (ii) internal and external auditors oversee the conduct of management and (iii) management has opportunities to express their views on the performance of external auditors and audit committee members.

Researchers and practitioners recognise the importance of board dynamics, and the social interactions necessary for effective boards and audit committees. There is always an element of healthy tension in the relationship between executives and audit committees.

Where executives perceive audit committees positively, they can be powerful supports to executives in achieving corporate compliance across their organisation. Executives can use audit committees in a manner which would potentially assist them in achieving higher levels of compliance.

Concluding comment

A better understanding of the practice of corporate governance (i.e., (i) corporate governance best practices, (ii) practitioners, and (iii) praxis) is necessary for effective corporate governance.

We argue that a holistic view of the practice of corporate governance is required, incorporating the status quo practices that underpin the practice of corporate governance, while recognising that effective corporate governance “in practice” is fluid, context-specific and depends on practitioners’ skills, initiative and adaptation.

Thus, we agree with Sir Winfried Bischoff, chairman of the FRC, when he suggested that the next review of the current UK Corporate Governance Code should retain its current flexibility and not involve throwing the baby out with the bathwater.

Best practice (e.g., the UK Corporate Governance Code) serves as a reference point for “the practice of corporate governance” which concerns what practitioners do (i.e., the praxis). Thus, as suggested by the FRC, “actual behaviour … is far more significant than a hundred statements” about what practitioners should do.

Further reading

Brennan, N.M. and Kirwan, C.E. (2017): “Implementing Corporate Governance: Practices, Practitioners, Praxis”, Accountancy Ireland, 49 (2): 76–77.

Financial Reporting Council (2016): Corporate Culture and the Role of Boards: Report of Observations.

Financial Reporting Council (2013): Lab Project Report: Reporting of Audit Committees.

Figures, 1, 2 and 3 are taken from Brennan, N.M. and Kirwan, C.E. (2015): “Audit Committees: Practices, Practitioners and Praxis of Governance”, Accounting, Auditing and Accountability Journal, 28 (4): 466–493.

Sir Winfried Bischoff, chairman of the FRC, speech on The Future of Governance, 16 February 2017.

Professor Niamh Brennan is the Michael MacCormac professor of management at University College Dublin.

Dr Collette Kirwan is a lecturer in accounting at Waterford Institute of Technology.