Sometimes development just comes thick and fast. So it was over the past ten days or so, for corporate governance.

It began with news that the review of the UK’s corporate governance code will likely highlight boardroom responsibility for culture, and potentially expand the responsibilities of remuneration committees to consider the pay not just of executives, but across companies as a whole.

And nomination committees could see themselves charged with developing an executive pipeline, not just filling executive seats when they become available.

Then there was the Taylor Review saying that the best way to make work better, even for the lowest-paid members of the workforce, would be through corporate governance, not through regulation. That needs some unpacking, but it basically says work should be fulfilling, it should be fairly paid with fair conditions and it is a boardroom’s responsibility to make it happen.

Lastly, came the interim report of the EU High-Level Expert Group on Sustainable Finance, which said fiduciary duties across Europe should include a responsibility to manage long-term sustainability risks.

The group has yet to produce its final report, but writing that risk into fiduciary duties essentially means writing it into law. Currently, all the work on persuading companies to operate with sustainability in mind has been about voluntary action. Adding it to fiduciary duties makes it a legal requirement. That’s a big step.

Big shift for boards

At the moment, it’s not clear where any of these issues will end. Aggregated, they could all mean significant change in governance requirements, and potentially a big shift in the work on the boardroom’s agenda. That said, for the best companies, with the most forward-thinking boards, these issues are already on their agendas, their directors already grappling with the issues.

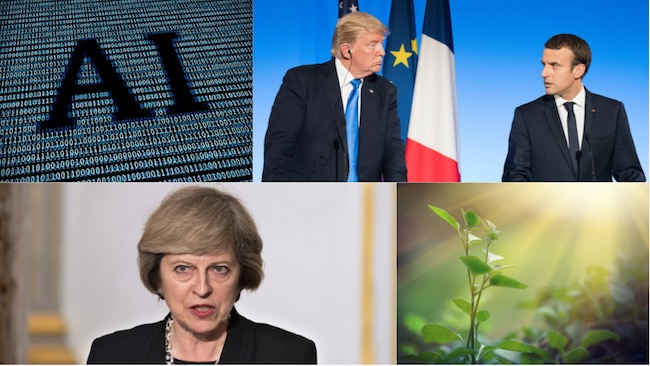

The one thing we can say for sure is that we currently function in an environment of uncertainty. Brexit, the rise of populist politics, geopolitical risk, slow economies and technological transformation have added to the uncertainty stew. And that is reflected in governance.

Governance is racing to keep pace and adapt. All these reports are direct results of the change and uncertainty in the world.

Company directors and non-executive directors are in the thick of it. They will need to adapt and adapt fast as politicians and regulators seek to address the evolving landscape of politics and economics. There will be little opportunity for rest.