Businesses that fail to understand that policy makers were serious about cuts to carbon usage at the Paris COP 21 meeting in December risk making themselves “vulnerable”, according to a report from senior academics.

Writing in response to a consultation run by the Task Force on Climate-Related Financial Disclosures, academics warn that businesses must adjust.

“…business models reliant on the assumption that governments were not serious in Paris are looking increasingly vulnerable,” say writers Dimitri Zenghelis and Lord Nicholas Stern of the ESRC Centre for Climate Change Economics and Policy, and the Grantham Research Institute on Climate Change and the Environment.

“What matters for ‘climate risk’ is that companies have a strategy in place to transition their business models to ones that are valuable once serious climate policies are in place, or once climate damages have accrued.

“This needs to be formulated into specific forward-looking strategies and scenarios, broken down by components regarding policies, technologies, weather and other salient risks.”

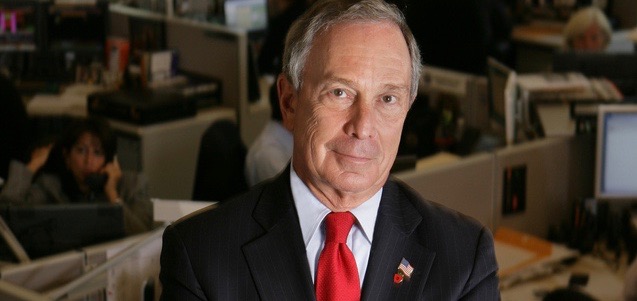

The Task Force, set up by the Financial Stability Board of the G20 group of countries and chaired by Michael Bloomberg, was created to develop voluntary climate-related risk disclosure guidance. In its first report published in March the Task Force set out fundamental principles for disclosure. A final report, including voluntary guidelines, will be produced by the end of 2016.

The academics in their submission say the Task Force should tackle the “absence of forward-looking assessment of business vulnerability” to climate change. They also want stress tests for risks associated with climate change.

“The danger is that too much data that is not salient is collected. The metrics needed to quantify a forward assessment are less straightforward than, say, data on emissions, but a simple yet credible forward-looking statement of strategy may be more valuable in informing investors than reams of backward-looking data. Resilience requires the presence of forward risk management and hedging strategies.

“In addition to answering the question ‘what is your most likely scenario?’ investors will seek to ask ‘what will you do in alternative scenarios such as a net zero emissions world?’ The answer to this puts market players in a better position to assess market capitalisation,” says the submission.

In reporting its next phase of work the Task Force says on its website: “In general, climate-related disclosures should be subject to good- governance processes and address as comprehensively as possible the significant impacts of climate change on the company’s business and the company’s strategy for managing related risks.”